Balance a monthly budget for a household and learn some financial saving and spending tips along the way.

Overview

Part of the “You Are the Economy” series of lessons, this lesson plan provides an introduction to personal finance and economics. For best results, follow the activities in order.

Big idea

Understanding personal finances helps us plan ahead as we become more involved in the wider economy.

Total time

70 minutes

Grade levels

Grades 7–12; Secondary I–V

Subject areas

Economics

- Personal economics and decision making

- Careers in economics

- Role of central banks in monetary policy

Business and careers

- Economic decision making for businesses

Health

- Making healthy decisions

- Financial literacy and media literacy

Math

- Using data to tell a story

Learning objectives

Students will:

- discuss possible incomes and expenses for different stages of life and living situations

- determine best practices for saving and spending

- identify possible risk factors for personal budgeting, such as inflation, unemployment, debt, etc.

- connect consumer spending and personal expenses to the larger financial system

Materials

Classroom supplies and technology

- Pens and pencils

- Whiteboard or chart paper and markers

- Projector or display screen hooked up to a computer

Handouts and worksheets

- Download the lesson plan, worksheets and answer key.

- Print the worksheets below:

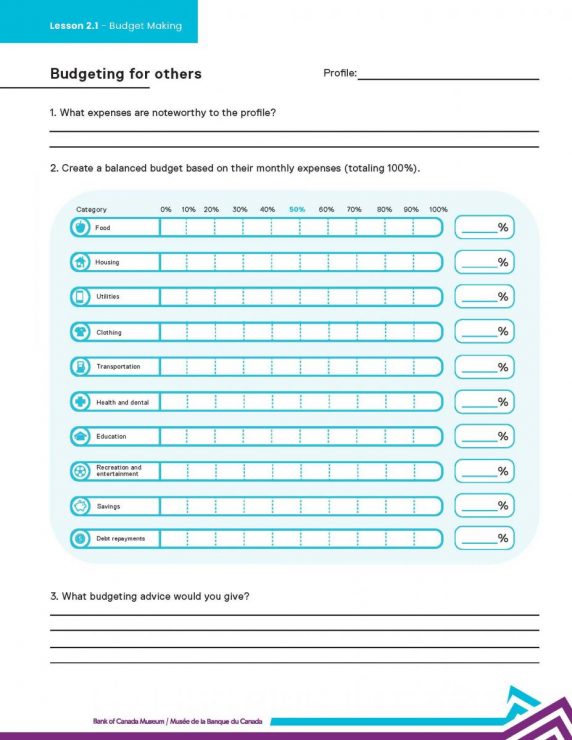

- “Budgeting for others” worksheet—single-sided, one copy per station (or displayed on a screen)

- Budget profile role cards—one role card per student, pair or small group

- Budget profile blank template (optional)—one per student if they will be creating their own profile

- Display or print these resources to review together:

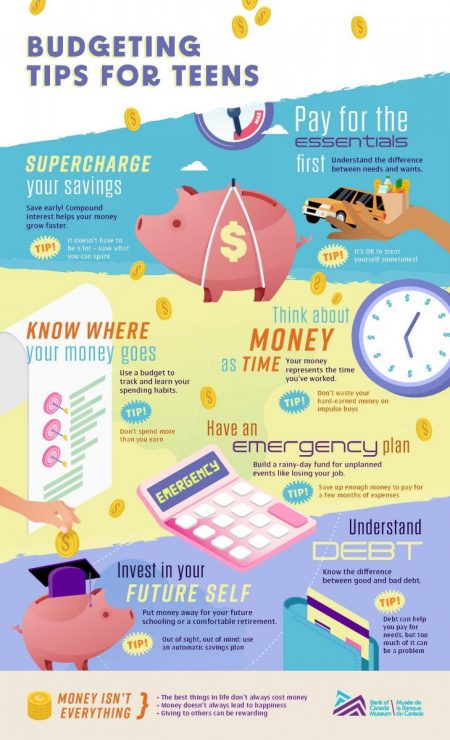

- “Budgeting tips for teens” infographic

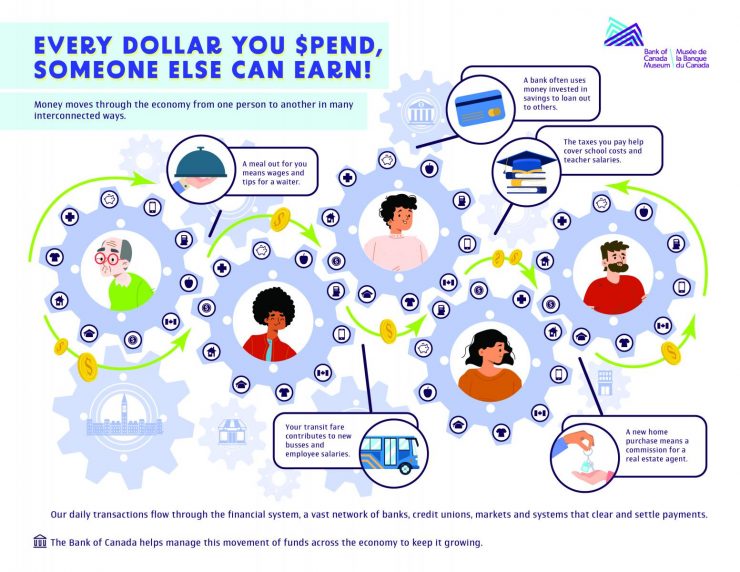

- “Every dollar you spend, someone else earns” infographic

Activity 1: Your personal budget

Begin with a discussion about budgeting and how money moves through the economy as each person earns and spends it.

Time

15 minutes

1.1 Opening discussion

Ask the class the following questions:

- Does your family use a budget to track saving and spending?

- Have you made a budget to save for something before? If so, was it helpful and how?

Remind your students that personal finances can be a sensitive topic. Before they begin the exercises, let students know they can choose to not disclose personal information. The activities focus more on possible types of personal expenses.

Explain to students that they will be thinking about the importance of budgeting for everyday and long-term expenses. Consider writing the following vocabulary concepts on the board to check for student understanding:

- gross income (the total income you make) versus net income (what’s left of your income after deductions like taxes)

- recurring costs and payments: costs to factor into a budget each month or year

- debt and repayment plans: agreements to repay a loan, credit card balance or other debt

- unexpected expenses and costs

- a rainy-day fund: money in case of an emergency, sudden life event or unexpected cost

- risk tolerance: your comfort level for spending or saving money and types of investments

1.2 Exploring budgeting categories

On a whiteboard or chart paper, write the following main categories of expenses: housing, utilities, transportation, food, clothing, health and medicine, education, recreation, savings and debt repayments. Then ask the class to brainstorm their current expenses, and write these under their category headings.

Then, have students add in household expenses paid for by other family members.

What is a recommended budget? As an extra challenge, have your students estimate what they think would be the ideal percentages for each of the main expense categories. Then reveal the following recommendations from the Credit Counselling Society: housing 35%, food 10–20%, utilities 5%, clothing 3–5%, gas and transportation 15–20%, health and medicine 3%, recreation (personal discretionary) 5–10%, debt payments 5–15%, savings 5–10%.

Another common approach is 50% needs, 30% discretionary, 20% savings—the 50/30/20 rule.

If helpful, raise some of the ideas below to prepare them for the budgeting exercise:

- Everyone has a different relationship with money. People choose how they spend and save based on their individual needs, their values about money and their views of the purpose of money.

- These financial values and beliefs can come from upbringing, culture, family and education.

- People’s risk tolerance impacts how they save and spend money. Whether they are more easygoing or cautious with the idea of spending or earning money is a key factor in how they will use it.

- Money involves a lot of psychology. Ask students which of the following perspectives of money they most and least relate to:

- money as love, a way to show affection

- money as power, a way to show status or exert control

- money as security, a safety net for survival, protection or the future

- money as independence, a way to gain personal freedom

Activity 2: Budgeting for others

Show students how different households have different budgets. Have them build a balanced monthly budget for a person, couple or family.

Time

30 minutes

2.1 Introduce the activity

Building off the expense categories on the board or chart paper, your students will now explore how different people budget based on their income, stage of life and family situation.

2.2 Budget for others

Hand out one copy of the “Budgeting for others” worksheet to each student. Then, give each student, pair or small group one of the budget profile role cards, either their choice or at random. Ask students to read the profile to “walk in another person’s shoes.” Then explain that they will create a monthly budget for that person, couple or family by divvying up 100% of the profile’s expenses across the various expense categories.

Students can choose between one of six budget profile role cards, each with their own unique situation.

For an extra challenge or more personalization, students could also use the budget profile template to create their own profile of an imaginary person, a friend or family member, or even themselves in the future. Students could then create a monthly budget for that profile.

For Question 1 on the worksheet, ask your students to brainstorm and take notes on what kinds of expenses may be required or noteworthy about their household’s living situation. While the profiles do not detail everything about the person, couple or family, your students can make an educated guess about some details.

For Question 2, the students need to balance their profile’s monthly budget, which may require some adjusting of their lifestyle. Have them fill in the percentage ranges for each expense category. (Suggest they use pencil if filling out by hand because they may want to adjust the numbers.) The goal is to allocate a total of 100% among all the categories considered.

Explain to students that, for the purposes of the activity, they should only allocate expenses of net income, and not gross income. While gross income is total income, net income is after tax and contributions for a pension and work health insurance are deducted. The only fixed category provided in each of the profiles is for housing.

If students need help, consider using these additional prompts to explore each category:

- Food: How big is the household, and how often do they eat out versus cooking at home? Is it more expensive to eat out or cook at home?

- Housing: A housing percentage is included in each profile. But what kind of housing do they live in, and do they share the space with others? Do they rent or own? If they are not renting, what about a mortgage, property tax, etc.?

- Utilities: Based on their household use of utilities today, what might they be paying for? For example, do any of their hobbies require a high-speed internet connection? Consider electricity, water, heating, phone and internet plans.

- Clothing: How often do they shop for new clothes, and what might their price range be? What can they afford?

- Gas and transportation: How are they getting to and from work, school and other places? How much would they spend on a transit pass, electricity or gas for vehicles, insurance, and monthly auto loan payments or savings for a vehicle?

- Health and medicine: Are there any health conditions they need to pay for? Or is everything covered by the public health care system or private health insurance?

- Education: Are they going to school? If they are paying off student loans, this [is/falls under] debt.

- Recreation and entertainment: How often do they go out, or stay at home and stream? Do they have any sporting or travel expenses?

- Savings: How much money can they comfortably put into savings or investments? Is their savings goal achievable?

- Debt: What kinds of debt do they have outside of a possible mortgage or car payments? Is it long-term or short-term debt? How might the repayments fit into the budget?

Each household profile also includes a section on risk tolerance. Each person has a different comfort level with spending and saving, and in particular what kinds of saving or investment portfolio they might choose. People with a higher risk tolerance may choose more volatile types of investments with the possibility of large returns, but also large losses. Those with a lower risk tolerance may invest with lower-interest rate savings accounts or bonds.

After students complete the percentage ranges for the expense categories, have them answer Question 3. The following questions can guide them as they come up with budgeting advice for their household. You may need to outline or explore advice for younger students.

- Are there any expense categories that you can’t really adjust to balance their budget?

- What kinds of unexpected costs or situations might happen to this person, couple or family, such as a family emergency, higher costs from inflation or someone losing their job? How much of an impact would this have on their budget? How can they be prepared?

- How might deductions on their earnings (such as pension contributions, employment insurance and taxes) affect their allocations for savings or spending?

2.3 Review results

Ask the students to present their budgets and answers in small groups, either with the same profile role card, or in groups with different profiles. Then have a class discussion using the prompts below after each group introduces their profile to the class.

Class discussion prompts:

- Are there any common features in the advice for your profile?

- Does your advice reveal any of your own beliefs about money?

Next, display the answer key on a projector or display screen. Provide some suggestions for each profile’s monthly budget.

Suggested percentage ranges for each expense category appear in the answer key, recognizing that everyone’s circumstances are unique.

Remind students of a few things as a follow-up:

- Debt is an important consideration for budgeting because many people borrow more money than they make. It can be challenging for people to balance their budgets without borrowing unless they are cautious about their spending. Debt can be considered good or bad depending on the level of interest charged for the loan or payment, the reason for the debt and whether the debt will generally lead to a positive or negative long-term outcome.

- Some expenses tend to sneak up on people, such as annual payments for insurance, a sudden health or travel need for an emergency, or home maintenance. Giving a budget some wiggle room for these elements is really important.

Activity 3: Budgeting best practices

Next, review an infographic with budgeting tips.

Time

15 minutes

3.1 Review budgeting tips

Following the budget profile activity, ask your students to think about what types of budgeting advice they may give to [themselves and?] others. Was there any common advice in Question 3 of the worksheet that [they feel] was important? Write a few of these on the board if time allows.

Then display or hand out the “Budgeting Tips for Teens” infographic. Review it together and discuss the advice. Are there any ideas that [match/reflect] their profile advice?

Conclusion

Connect daily expenses to the broader economy using a graphic.

Time

10 minutes

Display or hand out the graphic below. It helps to show the interconnectedness of different people and institutions within the financial system, connecting back to household spending. Ask your students the following questions:

- How does this image explain the movement of household spending?

- How might larger [financial?] institutions be impacted by changes in consumer income or spending?

- What does this image tell you about the wider economy?

Around 28 million financial transactions take place in Canada each day. Canada’s financial system keeps moving thanks to massive movements of money between institutions to settle all those transactions. The Bank of Canada ensures that liquidity (or money) moves throughout the Canadian economy to keep it strong. This includes being the “lender of last resort,” loaning to financial institutions at the end of the day if they are unable to settle their balances with other banks.

Key takeaways

- A monthly budget is a vital roadmap for current and future spending.

- Budgets vary depending on your stage of life: your income, priorities, major expenses and living situation.

- Our ongoing saving and spending make up a part of the larger economy and financial system.

Extensions

- Create a more precise budget using the online calculator from the Financial Consumer Agency of Canada. The calculator includes fillable category fields of income, savings, and fixed, variable and irregular expenses.

- Show spending, work and employment numbers from your region of Canada using “Your Place in the Canadian Economy,” a five-step interactive quiz.

- Have students explore the web app from Your Money Students to explore future expenses and income in a quick format.

- Encourage further student research into guaranteed basic income, social housing benefits, racial inequality and access to credit, economic markets, etc.

- Explore different occupations, skills and careers with quizzes from the Government of Canada’s Job Bank.

- Discuss with your students the unique budgeting challenges in their community. What financial decisions are unique to their local context, such as the cost of housing, access to transit for jobs, etc.?

- Look at the impact of saving for post-secondary education. Then discuss the article “Learning and earning” and explore the Financial Consumer Agency of Canada’s resources.

- Curious about how wages are determined? Explore average wages of different jobs and professions by reading our article “Making cents of wages.”

We want to hear from you

Comment or suggestion? Fill out this form.

Questions? Send us an email.