Make investment decisions based on what’s important to you and see how your spending and earning connects you to the global economy.

Overview

Part of the “You Are the Economy” series of lessons, this lesson introduces the global economy and the risks and rewards of investing. For best results, follow the activities in order.

Big idea

Your investment decisions are connected to the global market economy.

Total time

75 minutes

Grade levels

Grades 7–12; Secondary I–V

Subject areas

Social studies

- social, economic and political issues: challenges and opportunities

- regional and international economic development

- globalization

- sustainability of human systems

Economics and business

- investing and investments

- global supply chains

- corporate social responsibility

- risk tolerance for investing

- ethical issues in international business

Learning objectives

Students will:

- identify and differentiate between types of financial investments

- connect everyday consumption and use of resources to the global economy

- determine their own risk tolerance and personal priorities for investing

- assess the pros and cons of investing in different companies while considering environmental, societal and governmental priorities

Materials

Classroom supplies and technology

- pens or pencils

- whiteboard or chart paper and markers

- sticky notes (optional)

- smartboard or projector and screen

- calculator

- internet-connected devices such as phones, tablets or computers (optional)

- online collaborative mind map and drawing applications (both optional)

Handouts and worksheets

- Download the lesson plan, company profiles, and investment decision worksheet.

- Print these resources:

- Access and display this resource or share it digitally with students:

- “Risk tolerance” online quiz

For low-printing options, you can ask students to:

- use their notebooks to record answers to the online quiz and calculate their scores

- create the nine-diamond sorting chart in their notebooks or with a drawing application on their device

- view the company profiles on their device, a smartboard or a screen

- fill out the PDF version of the worksheet online or write their answers in their notebook

Activity 1: Connect to global markets

Time

15 minutes plus preparation time at home before the activity begins

1.1 Identify objects and where they were made

A day or two before the lesson, ask your students to choose between 5 and 10 objects around their home and write down where they were manufactured. You may want to offer some suggestions for object categories, such as clothing and fashion, electronics, hardware, and food and beverages. The objects should also have a range of monetary values.

If students are unable to complete this in advance, ask them to walk around the school, find objects from a range of categories and values and write down their country of manufacture.

Back in class, ask students to write down each object they listed along with its country of manufacture. They can write these on sticky notes, on a class whiteboard with a pen, or in a note-taking application on their devices. Next, either display a map of the world on a smartboard or screen or draw a world map outline on a whiteboard. Have the students arrange their notes to group objects by country and/or region of the world. Alternatively, if they are using a collaborative mind map tool on their devices, ask them to create bubbles to group objects by region or/and country.

1.2 Opening discussion

Ask your students a few questions:

- Were you surprised by the origins of any of the objects? Why or why not?

- What regions or countries of the world do you notice come up most often?

- Why do you think many manufactured goods are made outside of Canada?

- What are some incentives for companies to manufacture goods outside of Canada?

- What do the objects indicate about your connection to the global economy?

- These objects are goods. But services for people in Canada can also happen abroad. Can you think of examples of services that are outsourced to other countries?

- What made-in-Canada goods do you think a student would come across if they were doing the same activity in another part of the world?

Introduce the idea of global supply chains. If needed, start with the following overview:

Industries use a series of processes to take a product from creation through to sale and use. Businesses may even move the product between different factories for different steps in producing it. The more steps in a supply chain, the more risk of delays or production. But these risks may be outweighed by increased efficiencies through cutting labour and production costs.

Then, share the following facts with your students:

- During the 1990s, global supply chains grew longer, due to advanced technology. Both trade and investment became freer across international borders—especially for China and other major emerging-market economies.

- Trade agreements mean fewer tariffs or other costs imposed by an importing country.

- Since the move to freer trade, it’s common to find everyday goods made exclusively in other countries or with parts (or even food ingredients) that come from a variety of countries.

- Technological efficiencies mean that geography is less of a concern today for transporting goods than it would have been even fifty years ago.

Next, lead students into a discussion about the role of specialization:

- If a country has the expertise and resources to produce a product more efficiently than others, it has a comparative advantage over a country that could make the same product but at a higher price.

- For example, students may notice that a lot of electronics and consumer goods are made in Asia where there are specialized workforces and advanced technologies for such things.

- Some countries may simply have much lower costs for labour in manufacturing.

- It is common for globally manufactured goods, such as vehicles, to be built with components originating from different countries.

- Services such as telemarketing can be outsourced if workers can be paid lower wages or have specializations that are hard to find elsewhere.

Explain to your students that today they’ll be thinking about how to make a global investment decision for themselves. They’ll begin by exploring how much risk they can tolerate and follow with an exploration of the types of investments available to the global investor.

Activity 2: Determine risk tolerance

Take a short quiz to determine personal risk tolerance before moving on to discuss different types of investments.

Time

20 minutes

2.1 Take a quiz to determine your risk tolerance

Explain to students that before they do an investment simulation, they’ll need to think about their general risk tolerance when it comes to money. Knowing the level of risk they feel comfortable with is helpful when making money decisions. We usually say that someone’s investment risk is low (conservative), moderate or high (aggressive). Once the students understand their own risk tolerance, they can think about which investments appeal the most to them in global marketplaces.

Have them open and complete the “Risk tolerance” online quiz on their devices. Alternatively, display the quiz and work through the questions together with your students, then have them write down their answers in their notebooks.

A quick quiz to assess risk tolerance when it comes to investments.

The online quiz will tabulate their results automatically. If they’re doing it on paper, they can use the following answer key:

- All “A” responses: low risk tolerance

- Some “A” responses: somewhat low risk tolerance

- Mostly “B” responses: moderate risk tolerance

- Mostly “C” responses: somewhat high risk tolerance

- All “C” responses: high risk tolerance

Review answers with your students, reminding them that risk tolerance can be situational and can change over time. Explain that a person’s financial risk tolerance can be different than their appetite for taking risks in other activities or situations. Factors such as age, level of disposable income, and family and cultural connections can also shape a person’s perspectives on investment. Older people, for example, are more likely to be conservative about financial risk to ensure a stable return as they near retirement.

2.2 Explore different types of investments

Begin by explaining why people invest. For example:

- Money loses value over time due to inflation, so if a person’s investments do not earn interest above the inflation rate, they’re actually losing money.

- Investing helps grow wealth over time.

- Invested savings also allow a person to work toward short- and long-term financial goals, such as funding post-secondary education, making a major purchase or saving for retirement.

Ask your students to think about different types of financial investments they can make. Introduce the term “assets,” meaning items that hold value. Brainstorm together and help your students identify types of investments. If helpful, provide a partially completed version of the investment list below on a whiteboard or smart board and fill out the types of investments together.

This is a simplified list of investments, but you may want to go deeper into specific investments and more subtypes, such as property, foreign exchange trading, mutual funds, cryptocurrencies, options and futures. This activity can also lead to a wider discussion of historically low-risk versus high-risk investments.

Stock

- Stock is capital that a company raises by selling shares. The person buying shares becomes a part owner of that company.

- Often traded on a stock market, shares are usually purchased through a stockbroker or financial institution.

- Some stocks also include dividends: a share of the profits of a company, paid regularly to stockholders.

- Some stockholders own large percentages of a company’s stock, giving them a measure of control over the company.

Bonds

- Bonds are investments with fixed rates of return spread over fixed periods of time.

- They are effectively a loan that a person makes to the government or a corporation, which then guarantees to pay back the loan plus interest at a specific time (its maturity date).

- Cashing bonds in before they mature usually results in penalties, while some bonds cannot be cashed in before the maturity date.

Real estate

- Real estate investments are very popular because people expect that the value of homes and land will nearly always increase with time.

- Real estate is often bought and sold as its value rises or falls in an area.

Commodities and collectibles

- Some valuable items are considered investments.

- Commodities such as oil, grain and precious metals (for example, silver from a silver mine) are raw materials used to make goods and can fluctuate in value, based on supply and demand.

- Collectibles such as jewellery, art, antiques and precious metals (for example, a silver teapot) often either hold their value or increase in value over time.

Discuss with students that each of these types of investments comes with a variety of risks and benefits. For example:

- Government bonds are traditionally considered safe investments because people expect the loan will be repaid. In exchange for this safety, the interest earned on a bond is usually small.

- The value of specific stocks may go up or down, depending on investor confidence that the company will make a profit or grow.

- The value of art and jewellery is at the whim of fashion trends and popularity, so a fixed return on these types of investments is by no means guaranteed.

Business and household investments can have a collective impact on the stability of Canada’s financial system. The Bank of Canada is one of several federal and provincial entities that support Canada’s financial stability. The Bank analyzes financial health across the system to ensure the financial sector is running smoothly and is resilient to any threats or challenges. For example, if many households’ or businesses’ investments perform poorly , these collective system pressures can affect financial institution access to funds and credits.

Activity 3: Sort investment risks and priorities

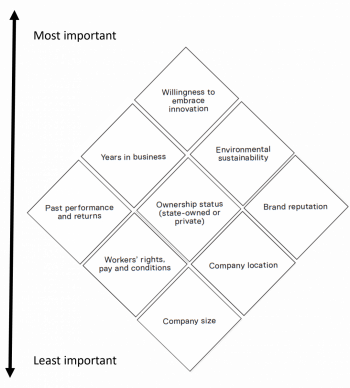

As you approach the investing simulation, use a nine-diamond sorting chart to help your students prioritize what is most important to them when choosing an investment.

Time

10 minutes

3.1 Sort your investment priorities

Instruct your students to build a diamond sorting chart, as shown in the diagram below. They can create this in their notebooks or with a drawing application on their devices. As they build their diamond chart, ask them to reflect on what would be most important to them when they think of companies to invest in.

Using the items in the following list, students should place what is most important to them in the top diamond and what is least important in the bottom one. The second row of diamonds is for priorities they feel are somewhat important, while somewhat unimportant ones go in the fourth row. The third row is for those that they feel are neither important nor unimportant.

- Past performance and returns

- Company size

- Company location

- Brand reputation

- Workers’ rights, pay and conditions

- Ownership status (state-owned or private)

- Years in business

- Willingness to embrace innovation

- Environmental sustainability

Place your nine investment priorities into a diamond chart, with your highest priority at the top and moving down to your lowest priority.

After your students have completed their diamond chart, have them discuss their results and the reasons for their choices with a neighbour or in small groups.

If time allows, you might also want to get a sense of which priorities the class as a whole considered most and least important. You can do this by reading out each of the priorities on the list and tallying by a show of hands the number of times each was in your students’ top and bottom spots. These data can help inform a broader class discussion on investment priorities.

Activity 4: Simulation for making investment decisions

Guide your students to invest in one of four companies. Then have them consider what unexpected consequences can come from their choices.

Time

25 minutes

4.1 Introduce the simulation

Now that your students have a good sense of different types of investments, different priorities and their own level of financial risk, display and read aloud the following investment simulation:

You are ready to invest and have chosen to buy shares in a company that makes shoes, a staple consumer good. You’ve noticed that unique, one-of-a-kind shoes are popular in your friend group. You think you could make some money, given your awareness of brands in this market. You start looking at different options and land on four companies that you think make some pretty stylish shoes. You have $1,000 to invest. However, you can only invest in shares of one company, and you are committing to invest for one year, through the highs and the lows.

4.2 Choose a company to invest in

Post one of the four company profiles at each of four different places around the classroom. Alternatively, students can digitally access the profiles on their devices or work with printed copies.

Have your students review each of the profiles—for the companies Veloz, North Stride, Bravado and Grizzle. Then, each student should determine which company they wish to buy shares in, based on their appetite for risk and investment priorities. Alternatively, students can review them together in small groups.

Give each student a copy of the investment decision worksheet. Alternatively, display it on a smartboard or screen or have them access it on their devices. Explain that they must complete the following information in the worksheet:

- Their chosen company’s anticipated rate of return, based on its performance during the previous year

- A justification of their company choice and expectations for their investment

- Some potential risks that their company could face, based on the information in its profile

Students outline and justify their company choice using this worksheet.

4.3 Analyze how events shift markets

When students have completed their worksheet, ask them to come together again as a whole class. Take some time to discuss which company they selected and why.

You can take this conversation a few ways, using some of the following prompts:

- Read out each company name one by one and have students raise their hands to indicate their choice or make this more interactive by directing students to different corners of the room, one corner for each company, to reflect their choices. Then ask the students to share the rationale for the company they chose.

- Ask your students how their level of risk tolerance and their investment priorities influenced their investment choice. What kinds of trade-offs did they consider?

- Have your students share other considerations specific to each company that shaped their decision (such as the consumer market, public perception, etc.)

Explain that any investment can be affected by forces out of the investor’s control. For example:

- As a small investor, they would have little or no say in the operations of a company.

- External events unrest can affect a company in a local, regional or international market.

Next, ask each student to choose three numbers between one and ten. They should record the numbers in the order they choose them (e.g., 9, then 4, then 5) in their notebooks or devices or on the back of their worksheets.

Explain that their investment year has now ended and that each number they chose corresponds to an event that happened during the year to their company. Display on a smartboard or screen—or read aloud—each of the external events below, and have your students note the impact on their investment of the three events, in the order that they chose them. Because each student has chosen different numbers, their company will each be affected differently: for example, some events might have no impact on their company, but others might have positive or negative effects. If none of the events affects their company, the rate of return on their investment remains the same as the previous year.

- A rise in protectionist measures from the government in Veloz’s region has raised export tariffs and import fees. The return on your investment is 40% lower than you expected.

- Grizzle’s unionized employees went on strike for three months. Because of this, the factory could only produce a third of what they promised to retail stores. The drop in supply raised shoe prices somewhat, but Grizzle’s overall profits went down. Your return is 25% lower than you expected.

- One of the materials found in the shoes from Veloz and North Stride was found to be carcinogenic, requiring the shoes to be sold with a warning. This event scared investors and lowered both companies’ returns by 25%. Shoes from Grizzle are certified free of the chemical and end up serving as an eco-conscious substitute for consumers, boosting the company’s profile and raising your return by 25% more than you expected.

- A series of severe weather events has affected global supply and shipping chains. Shipments of shoes from North Stride and Bravado were delayed for months, meaning they later had to be sold off-season for a discount. Both North Stride’s and Bravado’s investors face returns 25% lower than expected.

- The founder of Grizzle made national headlines for a tax evasion scandal. The brand reputation of the company has been affected, and demand for its shoes have gone down by a third. Your return on investment is 50% lower than you expected.

- An influential actor is spotted wearing shoes from Bravado and begins raving about them online. They become a coveted fashion item, and the rising value of the company gives you a 50% increase on your investment return. Veloz also rides this trend as a popular budget-conscious substitute, and the return on investment is up 20%.

- Regional trade agreements have led North Stride to open a factory in your region, reducing costs for local retailers. Investment returns on the company go up 25% by the end of the year.

- The value of the Canadian dollar shifts, affecting locally and foreign made products in different ways:

- Veloz’s shoes are now a bit cheaper, so Veloz investors see a rise of 20% on their investment.

- North Stride’s shoes are a lot cheaper and sell en masse, so investment returns are 40% higher than expected.

- Bravado’s shoes are more expensive, and investors lose confidence, resulting in a 25% loss on your return.

- Grizzle’s sales are not affected, so returns on investment stay the same.

- Grizzle receives a lot of good press as a “made in Canada” success story, allowing it to attract new corporate investment and therefore expand its operations. This leads to a 50% increase on the return on your investment.

- A new trade agreement between Canada and Bravado’s manufacturing country means that tariffs are reduced for shoes sold in Canada. This boosts investor confidence and increases the investor returns by 25%.

When students have noted which external events affected their company, ask them to calculate the final total return on their investment. They may wish to use a calculator or their device for this step.

Next, have students partner with a neighbour, or pair each student with someone else who chose the same business. Ask the pairs to discuss how the various external events affected their investment.

As a class, ask a few students to share their answers to the following questions:

- Overall, did you end up with a higher or lower return on your investment than you expected?

- If you were to invest again, would you choose the same company. Why or why not?

- Were you surprised by some of the unexpected events that happened? Can you think of any real-life connections?

As an extension activity, ask your students to create a short annual report for clients of or potential investors in their company. They should explain what happened to the company during the year and consider what steps they would take next. For example, would they expand or reduce the company, keep it the same size, or change certain suppliers or distributors ? Ask them to explain their decision.

Conclusion

Ask students to share what they’ve learned about types of investments, risk tolerance, investment priorities and the complexities of global markets from these activities.

Time

5 minutes

Key takeaways

- Investment decisions are often based on personal risk-tolerance priorities as well as on analyzing key company information.

- Global trade comes with varying degrees of ethical considerations, such as the environment, workers’ rights and geopolitical systems.

- Global markets include supply chains and investments across country and regional borders.

Extensions

- Take a more in-depth quiz on investment and determine how closely your profile reflects other Canadians. Check out the Ontario Securities Commission’s risk survey.

- Explore your local securities commission to find investing information for your province or territory.

- Research ethical investing concepts and criteria, such as B corporations, corporate social responsibility (CSR) and environmental, social and governance (ESG) investing.

- Have students calculate their individual carbon footprint, greenhouse gas equivalencies or other environmental impacts (such as water and energy).

- Delve deeper into floating exchange rates, international assets and confidence in global markets. Show how a common currency can be used for international investing by adjusting the value of the Canadian dollar. Begin by learning to calculate exchange rates by completing the Making Sense of Currencies activity.

We want to hear from you

Comment or suggestion? Fill out this form.

Questions? Send us an email.