Frequently asked questions for students and teachers

Cryptocurrencies can potentially change how we use—and even think about—money. Most of us are aware of them, but how much do we really understand about them?

What is a cryptocurrency?

Cryptocurrency is a form of digital currency that gets its name from the encryption software it uses to verify transactions. You can exchange regular money for cryptocurrency and use it to buy things online or transfer it to someone else. It’s a currency not backed by any central bank.

When was cryptocurrency invented?

The first cryptocurrency, Bitcoin, went online in January 2009. But it wasn’t until May 22, 2010 that a computer programmer named Laszlo Hanyecz made the first documented Bitcoin purchase. He bought two pizzas for 10,000 bitcoin, or a bit under 40 Canadian dollars at that time. Bitcoin is still the most common cryptocurrency in use, but there are thousands of others out

Who controls a cryptocurrency?

Nobody controls a cryptocurrency—that’s one of its defining features. They are “peer-to-peer” payment systems. Because they are not controlled by any government or single entity, cryptocurrencies are called "decentralized.”

What are the advantages of a cryptocurrency?

Reasons for using a cryptocurrency differ from person to person. Therefore, not all of these advantages will be seen positively by everybody.

- A cryptocurrency can act as a fast and seamless international money transfer system.

- Cryptocurrencies are sometimes seen as investments.

- Transactions are secure and their details are not visible.

- They are more private than bank account payments.

- Cryptocurrency does not require the users to have a bank account.

- No personal verification, credit checks or background checks are needed to use online currencies.

What are some of the risks associated with cryptocurrency?

- Cryptocurrencies are frequently used as speculative investments and their values can rise and fall dramatically in short time spans, making them unsuitable as a currency for day-to-day use.

- Very few people or retailers accept cryptocurrency as a method of payment, which severely limits its practicality.

- The anonymity of a cryptocurrency increases its potential as a tool for criminals.

- If a cryptocurrency holder loses their encryption passwords, they lose access to that currency forever. Just like losing cash, the holder cannot recover it, and neither can anyone else on the network.

- Cryptocurrency holdings aren’t protected or insured like money in bank accounts. If the currency fails, you’re out of luck.

How it all works

Every cryptocurrency—and there are lots of them—has its own rules and processes. All promise to execute and record digital transactions so long as there is a network-wide consensus that the transactions are legitimate.

Bitcoin, for example, has a very complex way of validating transactions. It is called mining. Hundreds of thousands of computers scan a cryptocurrency network, looking for transactions to verify and add to the system’s publicly visible ledger called the blockchain. These mining computers are all competing to generate a valid "hash": a very long string of numbers that is derived from feeding the transactions’ data into a cryptographic program. The type of hash has specific parameters. It might take trillions, even quadrillions, of attempts to meet those parameters.

The miner that first obtains a valid hash is rewarded with new cryptocurrency, so using all that processing power is worth it for the miners—if they're successful.

This USB mining processor is from 2013. With it, an operator could have run a modest cryptocurrency mining business from a PC, executing up to 1.6 billion hashes per second. That sounds impressive but is not even close to the speeds of today’s mining computers.

Source: Data processor, erupter, block, Bitmain, Canada, 2013 | NCC 2018.8.2

How is a cryptocurrency stored, accessed and spent?

Most cryptocurrencies like Bitcoin exist only online and are recorded in a public ledger called a blockchain. This is a type of shared database in which all users remain anonymous but can see the transactions that take place. When a transaction occurs, the value doesn’t move but is merely assigned to another owner. So, you cannot remove a cryptocurrency’s value from the network like taking coins from a piggybank.

To use a cryptocurrency, you need a digital wallet—but this is not a physical object. It is software (held on a computer, smartphone or USB device) that manages cryptocurrency transactions. You use this software to send or receive cryptocurrency. The transaction includes the amount of currency, its origin and destination, and any applicable fees. The digital wallet holds the passwords (called keys) needed to access the cryptocurrency.

Keys can be long and are sometimes backed up on multiple electronic devices. Some users also keep physical backups, such as a QR code or even a written note.

If you lose your key, access to the cryptocurrency associated with it is lost—not just for you but for the entire network. It’s like dropping a coin down a drain, you know the money is there, you just can’t get at it.

Is cryptocurrency secure?

Inside a cryptocurrency network, transactions are secure and anonymous. But cryptocurrencies have a weak spot: exchanges. Cryptocurrency exchanges are websites where traditional funds can be traded for online currencies and vice versa—and cryptocurrencies traded with each other. Where cryptocurrencies are changed for cash are some of the few places where they have been traced to criminal activity.

Everything a cryptocurrency user needs to make a transaction is held on this device, even the wallet software. It only needs to be connected to a computer with internet access to work.

Source: Cryptocurrency hardware wallet, Ledger $A$, Canada, 2017 | NCC 2018.16.1

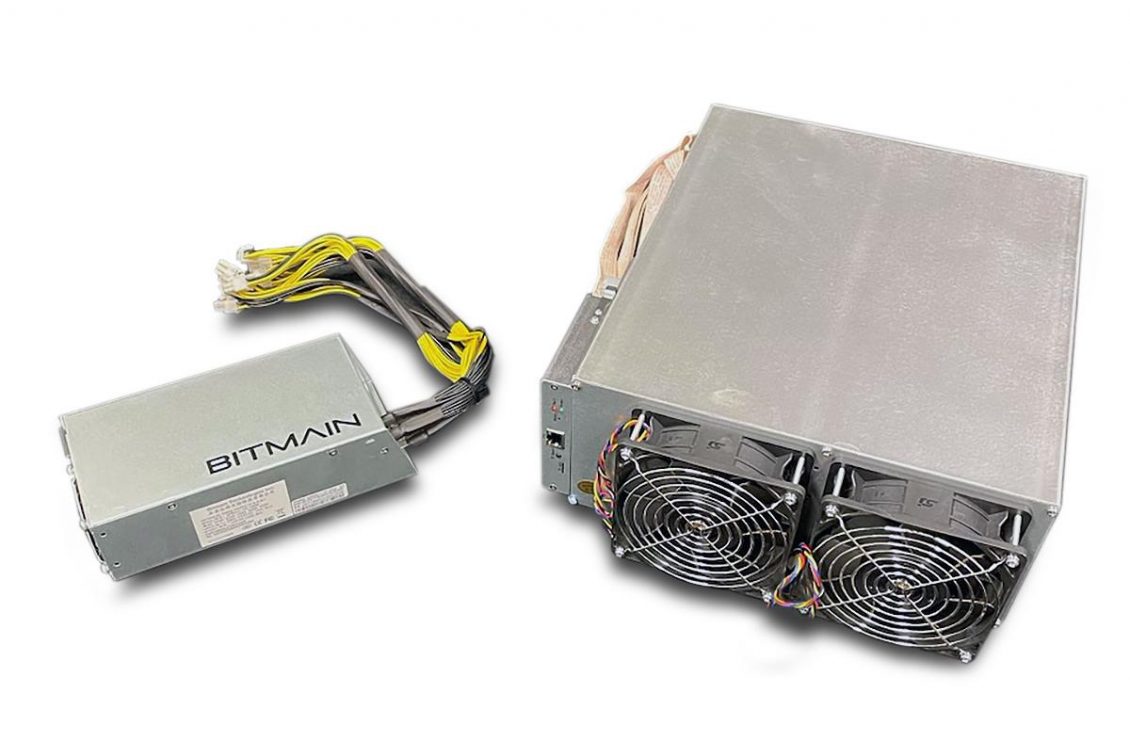

Though only from 2018, this cryptocurrency mining rig is woefully out of date. Current machines can process more than 200 quintillion hashes per second and are chained together in warehouses called mining farms.

Source: Mining Computer, Ethereum, Bitmain Antminer E3, China, 2018 | NCC 2022.31.0

Could cryptocurrency replace the Canadian dollar?

Cryptocurrencies are not a suitable replacement for the Canadian dollar for many reasons. As far as cash is concerned, cryptocurrency values are far too unstable and can’t touch our bank notes for their reliable value, broad acceptance and secure backing. And as digital tools, cryptocurrency systems do not have the capacity to process even a small fraction of Canada’s daily credit and debit card transactions—let alone the rest of the world’s.

Because so many computers are on the network competing to verify transactions, mining a single bitcoin, for example, consumes more energy than nearly 2 billion credit card transactions. This carbon footprint is estimated to be many times larger than bank notes—a footprint even larger than mining the same value of real gold!

Will there be a Canadian digital currency?

Only a handful of central banks around the world now issue digital versions of their national currencies. These digital currencies are regulated and guaranteed to retain their value. The Bank of Canada is exploring the possibility of issuing a digital form of the Canadian dollar, also known as a central bank digital currency (CBDC), but it does not currently see the need for one. If a CBDC were created, it would simply be a digital form of the cash in your wallet.

What would a Canadian digital currency be like?

Simply put, a digital Canadian dollar would be a digital form of the cash in your wallet. Like cash, it could buy the things you need. But the advantage is that you could also use it for online purchases and to transfer money between family and friends. And businesses could use it to pay each other.

This new form of money would be issued by the Bank of Canada and provide benefits similar to cash: it would be safe, accessible to everyone and private.

But a digital Canadian dollar would not replace cash—the Bank of Canada would continue to supply bank notes as long as Canadians want to use them.

Why would we need a digital Canadian dollar?

People are making fewer and fewer cash transactions. It’s possible that, in the future, cryptocurrencies or CBDCs issued by other countries could be widely used in Canada. This could compromise the role of the Canadian dollar in our economy and affect the stability of our financial system.

A digital Canadian dollar could help protect our economy by ensuring Canadians always have an official, safe and stable digital payment option. And only a central bank can guarantee that public interest—not profit—is the top priority.

The Museum Blog

New acquisitions—2025 edition

From rare toonies to Métis scrip art, the Bank of Canada Museum’s 2025 acquisitions show how money and the economy shape Canadian lives.

Whatever happened to the penny? A history of our one-cent coin.

The idea of the penny as the basic denomination of an entire currency system has been with Canadians for as long as there has been a Canada. But the one-cent piece itself has been gone since 2012.

Good as gold? A simple explanation of the gold standard

In an ideal gold standard monetary system, every piece of paper currency represents an amount of gold held by an authority. But in practice, the gold standard system’s rules were extremely and repeatedly bent in the face of economic realities.