Money is all around us: we use it and think about it every day. You can take advantage of your daily economic activities to introduce important financial skills to your children and help them plan for their futures. Check out these free resources from the Bank of Canada Museum and others.

Little kids: How many quarters make a dollar?

What are the basic economic and math skills that really young children need to start with? Begin by exploring Canada’s coins and bank notes with these great worksheets for kids in Kindergarten and Grade 1. They can practise their addition and subtraction skills in the lesson “Counting Money and Making Change.” How many different combinations of coins can make up a dollar? How much will they need to buy what they want, and how much change would they get back? Download our printable play money for them to work with.

Teaching children how to use money is only the beginning. You also need to teach them how to spend it wisely. Helping children to understand the difference between needs and wants is key for them to make responsible spending decisions when they get older. We have a great activity, “Needs or wants? That is the question!,” to get you started.

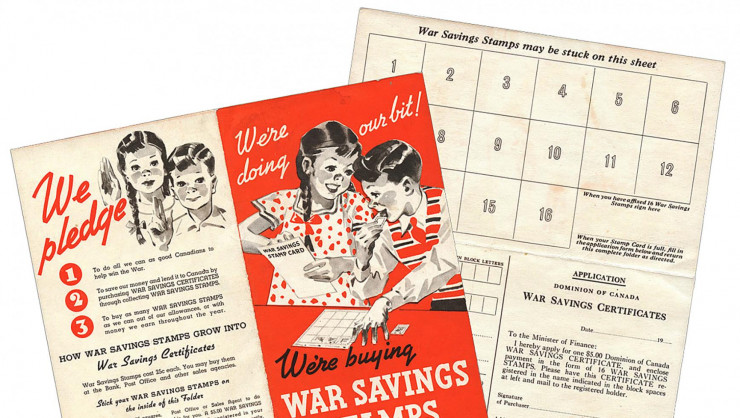

Introduce your kids to saving by helping them set a short-term saving goal, such as for a toy or a special treat. They can make their own piggy banks or buy something unique to sit on the bookshelf and hold their fortunes. You can also introduce the idea of interest by telling them that you’ll add money to what they can save themselves. For example, if they save $5, you’ll add $0.50. They’ll see that the more they save, the more their money will grow.

The Museum has dozens of piggy banks. But very few are actually pigs. The sheer variety of containers made for saving money is amazing.

Source: Coin banks, Canada, 1920s–1980s

Middle kids: A nickel saved is a nickel earned

Your kids might already have financial goals. Maybe they’re saving for a new video game (we recommend these video games to learn more about the economy), tickets for an activity or something special. Encourage your kids to set financial goals and then help them figure out how to get there. Do they need $200 for a new bike? What chores or neighbourhood jobs could they take on to earn this money? How long will it take them to save? Help them make a plan and stick with it.

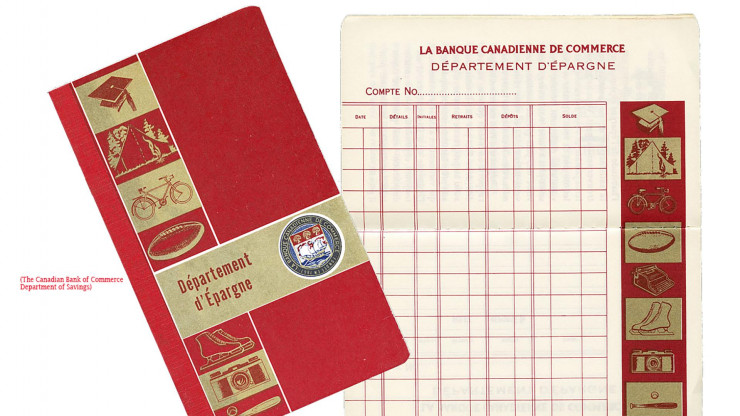

This is also a great time to help your kids get their first bank account.

Provide your kids with real-world experiences that they can participate in. Get them involved in planning a meal, grocery shopping and making dinner. Ask them to make a budget for their birthday party or a family vacation. As much as possible, let your kids see the financial decisions you make every day.

Big kids: Next stop, real life

For teenagers, saving money for short-term goals like a new bike or a skateboard will soon give way to saving money for college or university—investments with long-term payoffs. They can find out about the payoffs of higher education from our Bank of Canada economists. And in this resource from the Government of Canada, they can learn how much school can cost and how to pay for it. They’ll also need a good budget planner. Do you have your own household budget? It’s never too late to create one.

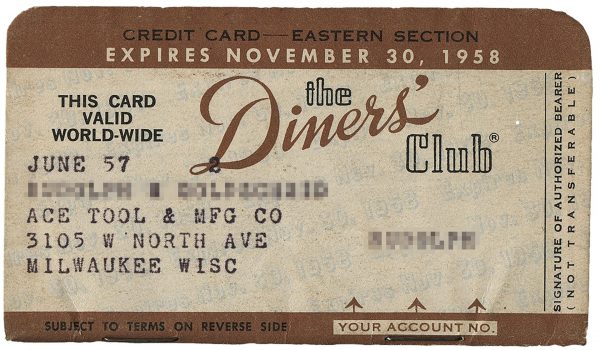

Young adults should also think about how to establish a credit rating and make sure they really understand debt. Teaching teens about the advantages, necessities and risks of loans and credit cards is important at this point in their lives. They can learn about different kinds of debt and how to manage it as well as how to choose a credit card. It’s okay if you’re learning too—financial literacy is a lifelong journey.

Choosing where to put savings is also very important. Advise your children not to let their money sit in that piggy bank for too long. Putting money into a bank account, tax-free savings account, registered education savings plan or registered retirement savings plan can help them reach short- and long-term savings goals. With compound interest, if your children start now to save a little bit each month, they could be millionaires before you are!

Keep the conversation going

Involve your kids in your financial lives. Talk with them about the importance of their choices and your own choices. Don’t be afraid to learn with them or to tell them about mistakes you’ve made. Make economics part of your kids’ lives long before they have to make ends meet on their own. We are the economy, and so are they.

The Museum Blog

Whatever happened to the penny? A history of our one-cent coin.

The idea of the penny as the basic denomination of an entire currency system has been with Canadians for as long as there has been a Canada. But the one-cent piece itself has been gone since 2012.

Good as gold? A simple explanation of the gold standard

In an ideal gold standard monetary system, every piece of paper currency represents an amount of gold held by an authority. But in practice, the gold standard system’s rules were extremely and repeatedly bent in the face of economic realities.

Speculating on the piggy bank

Ever since the first currencies allowed us to store value, we’ve needed a special place to store those shekels, drachmae and pennies. And the piggy bank—whether in pig form or not—has nearly always been there.