Rising inflation is everywhere in the news. How do we help youth understand what this means and how it applies to their lives?

COVID-19 has had an unprecedented effect on the economy: closing businesses, driving down demand for in-person services and interrupting supplies of many goods. With news stories and popular culture addressing inflation and why it’s high, now is the perfect time to explain this key economic concept to your high school students.

The basics

This video and the accompanying article are a great way to understand the basics of inflation. You can also follow up with our video discussion guide or read about inflation and inflation targeting in the Bank of Canada’s Explainers.

Get the conversation going

Try some of these discussion questions with your class.

- Is inflation bad? Why or why not?

- What are some of the ways that your life has been affected by inflation?

- Have you or your family had trouble buying specific goods or services?

- What are some items you’ve noticed cost more?

- Have you changed your buying behaviour during the pandemic?

- Who might be more affected by inflation? Why?

- What are some other ways you’ve noticed that COVID‑19 has affected the economy?

Why is inflation high at the moment?

In early 2022, the inflation rate is higher than it’s been for more than a decade. To understand why, the first thing your students need to understand is the consumer price index (CPI). Every month, Statistics Canada compiles a list of retail prices of a selection of goods and services. But the CPI is used to measure inflation on a year-over-year, not month-to-month, basis. This means that the current inflation rate reflects price changes from this month last year. In early 2021, many parts of Canada were under lockdown. During the lockdown, prices of many things in the CPI basket were lower than usual, so it’s normal to see higher inflation rates a year later when these prices went back up.

The pandemic led to changes in the behaviour of consumers. Demand for services went down, especially for things like travel, live entertainment, and restaurants. Since consumers weren’t spending on these things, they spent more on goods.

Then, across Canada, restrictions on businesses were lifted and the economy reopened in the second half of 2021. This led to a rapid recovery in demand in Canada and many other countries. At the same time, global supply bottlenecks caused in part by the speed of the reopening and other factors unique to the pandemic, has led to higher inflation lasting longer than anticipated. Canadians who saved money in 2020 and 2021 are now spending more and demand across the economy is rising as many people slowly return to work, travel and leisure activities. Consumers’ behaviour influences prices and inflation.

The supply chain has been affected in many ways since the beginning of the COVID‑19 pandemic.

The supply chain and why it matters

A supply chain is the connection between a company and its suppliers and producers—from resource extraction to manufacturing and right on through to the arrival of products on the store shelf. These supply chains often stretch around the world. In many cases, supply chains are not currently able to keep up with the new demand.

Several things have affected supply chains throughout the COVID‑19 pandemic. Border and travel restrictions around the world hindered the movement of goods. Public health restrictions slowed production at factories and distribution of goods. And at the end of 2021, the floods in British Columbia further complicated shipping through the port of Vancouver.

A good example for your students is the global shortage of semiconductor chips. This worldwide shortage has been caused by many different factors: COVID‑19 lockdowns, trade restrictions and severe weather. These chips are found in cars, phones and just about anything electronic. Students may have heard that, as a result of the shortage, it’s harder to get hold of a new phone or gaming console. Because these chips are in so many of our favourite devices, they really highlight how global supply chains affect our lives.

Another good example is food prices. When you see a higher price on meat at the grocery store, what you’re seeing is the impact of a supply chain. Feed for livestock is more expensive because of weather conditions in western Canada, production is slower because of supply chain disruptions and health measures to protect workers and the energy costs of processing are higher. All of these expenses will get passed on to the consumer.

The impact on youth

Prices have risen in several areas, notably energy (including gasoline costs), costs of maintaining a home, groceries (especially meat, breakfast cereals, prepared produce and snacks like potato chips) and transportation.

But not all people experience inflation equally. For example, if you don’t drive or eat meat, your transport and grocery costs may be lower than your neighbour’s. For a student, you might notice that it costs more to fill up your gas tank or to eat at a restaurant, but you might not experience higher home heating costs or housing costs if you’re not responsible for paying them. You may have been saving up for a big purchase that suddenly costs more or is unavailable. And if you’re saving for university, you may need to think of the costs of rent, groceries and bills in the future.

Have your students calculate their personal inflation with this calculator from Statistics Canada.

What happens now?

According to its forecast in January 2022, the Bank of Canada expects that inflation will stay high in early 2022 and decrease to about 3% by the end of the year. In 2023, it should return closer to the Bank’s target of 2%, and within its control range of 1‑3% in 2023. Factors pushing up inflation, like supply chain issues, are for the most part tied to the pandemic. The travel and public health restrictions related to the pandemic should wane, the Canadian economy is growing and the job market is healthy. The Bank of Canada will continue to use its monetary policy tools to help guide inflation back towards its 2% target over time.

One main tool to control inflation is adjusting the policy interest rate. If the economy is struggling, as it was in 2020 when the pandemic hit, it might drop the rate to encourage spending and boost the economy. In fact, it has kept the policy interest rate as low as it can go during the pandemic for this very reason. But if the economy is growing too fast, as it is right now, the Bank might raise the policy interest rate to encourage people to save and slow down the economy.

Another tool the Bank of Canada can use is quantitative easing. It can be used to further lower interest rates when the policy interest rate is as low as it can go. Under quantitative easing, a central bank buys government bonds. Buying government bonds raises their price and lowers their return—the rate of interest they pay to bondholders. This rate of return is also known as the bond’s yield. Government bond yields have a big influence on other borrowing rates. Lower yields make it cheaper to borrow money. So, quantitative easing encourages households and businesses to borrow, spend and invest. As the economy recovered in the fall of 2021, the Bank stopped using this tool.

Let’s talk about resources

Here are some resources from the Bank of Canada Museum, the Bank of Canada and other trustworthy sources to help you and your students learn more about inflation.

Price Check: Inflation in Canada is a lesson plan for economics and business students in grades 10 to 12 and Secondary IV to CEGEP. It teaches the basics of inflation and the CPI. Students create their own price index to measure the prices that matter most to them.

Still have questions? Check out the Bank of Canada’s Explainers on how monetary policy works.

Statistics Canada’s Consumer price index portal has a wealth of information including data sets, infographics and a great data visualization tool. They also have a short video to explain the CPI.

For students, an excellent way to anchor this learning is to find local news articles about the impacts of inflation. Every community has personal stories of businesses and people who have felt these impacts. Encourage your students to scan the news for these stories and reflect on how they demonstrate the concepts above.

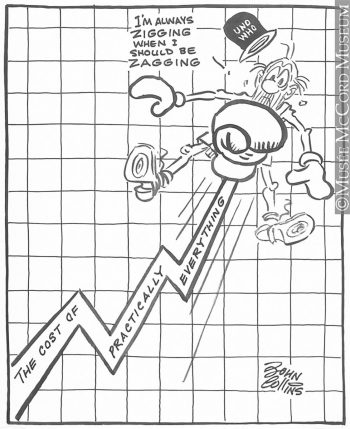

This editorial cartoon called “The Fight Against Inflation” by John Collins was published in The Gazette in 1969. Ask your students to look closely at this image. Then ask some questions about what they observe:

- What are some of the symbols and ideas you see in this cartoon?

- What words are written on the cartoon? What do they mean?

- What else can you observe?

- If this editorial cartoon was published today, would it have the same meaning? Does it represent what we are experiencing today with inflation?

Ask your students to search Canadian newspapers for recent editorial cartoons about inflation and compare them to this one.

The Museum Blog

Whatever happened to the penny? A history of our one-cent coin.

The idea of the penny as the basic denomination of an entire currency system has been with Canadians for as long as there has been a Canada. But the one-cent piece itself has been gone since 2012.

Good as gold? A simple explanation of the gold standard

In an ideal gold standard monetary system, every piece of paper currency represents an amount of gold held by an authority. But in practice, the gold standard system’s rules were extremely and repeatedly bent in the face of economic realities.

Speculating on the piggy bank

Ever since the first currencies allowed us to store value, we’ve needed a special place to store those shekels, drachmae and pennies. And the piggy bank—whether in pig form or not—has nearly always been there.